Before I even begin this article and the math and calculations, I believe in making a choice that you feel is in your best interest. In our opinion taking a shorter-term rate is a HUGE gamble! You are taking a big risk that rate will be low enough at the end of the term you choose to make up the large premium you paid in unnecessary interest.

We are going to use the same scenario for 4 different calculations. We are going to be renewing a $300,000 mortgage for a client who expressed interest in a 2-year fixed, 3-year fixed, 5-year fixed, and a 5-year closed variable.

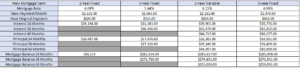

Mortgage Amount: $300,000.00

Transaction Type: Renewal/Switch/Transfer

Existing Rate: 3.69%

Existing Term: 5-year Fixed Insured

Renewal Date: January 30, 2024

Existing Payment: $1,528/month

Remaining Amortization: 20 Years.

Mortgage Insurer: Sagen

Scenario One: 2-year Fixed Insured

Mortgage Rate: 6.09%

Remaining Amortization: 20 years.

New Payment: $2,152/month

Total Interest 24months: $35,154

Total Principal 24 months: $16,487

Remaining Amortization End Of Term: 15 years

Remaining Mortgage Balance: $283,513

Scenario Two: 3-Year Fixed Insured

Mortgage Rate: 5.44%

Remaining Amortization: 20 years.

New Payment: $2,043/month

Total Interest 36months: $46,338

Total Principal 36 months: $27,220

Remaining Amortization End Of Term: 15 years

Remaining Mortgage Balance: $272,780

Scenario 3: 5-Year variable Closed Insured

Mortgage Rate: 6.15%

Remaining Amortization: 20 years.

New Payment: $2.162/month

Total Interest 60 months: $84,717

Total Principal 60 months: $44,997

Remaining Amortization End Of Term: 15 years

Remaining Mortgage Balance: $255,003

Scenario 4: 5-Year Fixed Insured

Mortgage Rate: 4.99%

Remaining Amortization: 20 years.

New Payment: $1,970/month

Total Interest 60months: $68,277

Total Principal 60 months: $49,909

Remaining Amortization End Of Term: 15 years

Remaining Mortgage Balance: $250,091

Here are the above scenarios in a handy spreadsheet

But wait! This isn’t an apples-to-apples comparison. How will a borrower know what will put them the furthest ahead in the long run? While no one has a crystal ball to make these predictions accurately, there are somethings that are often overlooked in the mortgage industry, which are PRIVILEGE PAYMENTS!

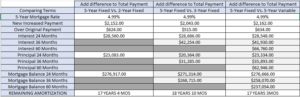

Instead of paying unnecessary interest rate premiums, what happens when you take a 5-year fixed and add the savings directly to your principal payments? Magic Happens!

You will probably come out ahead if you take a 5 year fixed and apply the difference in payment directly to you principal. You will pay LESS interest and MORE principal and reduce your overall mortgage amortization.

2-Year Vs. 5-Year

Interest Savings over 2 Years: $6,594.00

Extra Principal Paid: $6,596.00

Amortization reduced: 2 Years 6 Months

Rate to break even after 2 years under 4%.

3-Year Vs. 5-Year

Interest Savings Over 3 years: $4,084

Extra Principal Paid: $4,065

Amortization reduced 1 Year 2 mos.

Rate to Break Even after 3-year term is around 4%.

5Year Variable Vs 5-Year Fixed

Interest Savings over 5 Years: $17,957

Extra Principal Paid: $17,949

Amortization Reduced 2 Years 9 Mos.

To be fair, we can’t predict what variable rates will do and will likely be a safer bet than taking high premium short-term fixed rates.

The math will probably work out better taking the best 5-year fixed and paying extra!

Contact us to help you with your next mortgage!

contact form (1)