In this series, we are diving deep into the fine print of mortgage contracts and explain the terms. I also want to explain the mortgage elements that are important to me. I hope every existing mortgage holder and every soon-to-be mortgage holder will read this series of posts on social media and our blog. Please feel free to share with your friends, family, and colleagues.

MORTGAGE PENALTIES & FEES

We are going to calculate 3 penalties based on the same scenario.

Penalty 1: $3,100.00

Penalty 2: $11,000.00

Penalty 3: $13,750.00

Life happens. Divorce, death, disability, job loss, large repairs, new opportunities, winfalls, and hardships. These factors can turn one’s life upside down, and also will most likely affect your mortgage and where and how you live. The first area we are going to cover is mortgage pre-payment penalties. A mortgage prepayment penalty is a fee that will be charged to you by your lender if you, overpay your prepayment privilege amount, break or exit your mortgage contract early, switch/transfer your mortgage to a new lender before the end of your closed mortgage term or pay your mortgage balance in full before the end of the closed term.

There are two types of terms, open and closed. An open term is generally more expensive in terms of rate (usually 1%-2% higher than the lower closed term), but you are allowed to pay as much principal as you like, at any time without penalty.

A closed term is lower cost to borrowers and will be restricted or closed to the amount you are allowed to pay each year (usually 10%-20% annually), some lenders will allow you to increase each installment payment (usually 10% to as high as a double up).

Not all penalties are calculated the same way by each lender. There are three types of penalties, an IRD – Interest Rate Differential, an IP – Interest Penalty (usually 3mos), and a POB – Percentage Of Balance Penalty. Almost all lenders who offer closed terms will have these three penalties in the fine print. Most mortgage contracts will state in the event that you violate the contract by overpaying or breaking the mortgage you will pay the “GREATER” of the Interest Differential Penalty or the Interest Penalty. Most borrowers’ brains will assume, or lead them to believe that the 3-month interest rate penalty will be greater, which will be the penalty charged if they break their mortgage. This assumption can be VERY COSTLY. The POB – Percentage of balance penalty is what it is, usually 2.75% – 3% of the outstanding mortgage balance at the time.

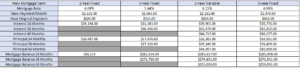

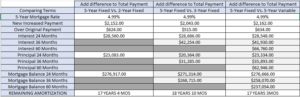

Let’s calculate a 3-month interest penalty. In today’s market, a $500,000 mortgage at a 5.19% 5-year fixed rate, amortized over 25 years will have a monthly mortgage payment of $2,962.34. At the beginning of the mortgage term, your principal portion of this payment is $823/month and your interest portion is $2,139. A 3-month interest penalty in the first 5-year term of the mortgage will range between $5,712 and $6,417 depending on when the mortgage is paid in full. It’s important to note that as the mortgage continues the principal amount will increase and the interest amount will decrease each payment. It is also important to note that at the end of the closed term the mortgage becomes open and no prepayment penalty will apply.

As today’s interest rates are higher today than they were 2-5 years ago, many borrowers breaking their closed-term mortgages will have this penalty.

What about IRD – Interest Rate Differential Penalties? These can be nasty and calculated very differently at each financial institution there is a Standard IRD and a Discounted IRD. The IRD is the amount of interest left owing from the time you break your mortgage to the end of the term. However, in the case of a Discounted IRD two different interest rates are used. The first is the posted rate at the time your mortgage was signed. The posted rate is not the rate you are paying on your mortgage, it’s the rate the lender will post on their interest rate board or website. Generally, the posted rate is 1.25% to 2.25% more than the borrower receives from the lender. If the 5-year fixed posted mortgage rate is 6.90% today and the lender gives you a discounted/contract rate of 5.4% this means in the eyes of the lender they have generously given you a discount of 1.5%. It doesn’t matter that the market/street rates are 5.4% or lower. If you break your mortgage at this lender your IRD Penalty will be calculated using the difference between the 6.9% and the current rate when the mortgage is broken. The current rate used to calculate the IRD can also be based on the current posted rate for a closed term with a similar length or the current posted rate for a term with a similar length less the original discount given. Confused? Yeah, me too. IRD calculations are a nasty business. Here are two examples that will hopefully clear it up.

Standard IRD:

$500,000 Mortgage Balance

2 years – 24 months remaining on the mortgage term.

5.19% – Current Mortgage Rate

4.99% – Lenders Current Mortgage Rate

[5.19%-4.99%]/12 x $500,000x 24 = $3,100.00

Discounted IRD:

$500,000 Mortgage Balance

2 year – 24 months remaining on the mortgage term

5.19% Current Mortgage Rate

6.79% Lenders Posted Rate at the time the mortgage started

1.60% Rate discount

5.69% Current 2-year rate offered by your lender.

[5.19%-(5.69%-1.60%)]/12 x $500,000 x 24 = $10,999

The difference in the relatively same scenario is $7,900.00

POB – Percentage Of Balance Penalty

$500,000 Mortgage Balance

2.75% Penalty Amount

[$500,000 x 2.75%] = $13,750

If you carry your mortgage to term and nothing happens in your life, then the mortgage penalty won’t even matter. However, if any of the following happens, the mortgage penalty will soon become one of the most important terms in your mortgage.

* Divorce resulting in the sale of the marital home

* Death resulting in the sale of the family home

* Disability or Illnesses resulting in the sale of the family home

* Job loss resulting in the sale of the family home.

* Wanting to transfer switch your mortgage to a new lender for a better rate

* Being transferred through work out of province resulting in the sale of the home and not being able to port or afford a new mortgage in the new city or province.

* A large inheritance or windfall that will allow you to pay your mortgage balance in full.

We’ve said it before and will say it again. Saving $11 per month on your mortgage payment on a rate could cost you $1000s of dollars should life happen.

Contact us today for a 2nd opinion on your mortgage!