This question came in through one of our social media platforms: “I’ve never used a mortgage broker before. How much can I really save?

Benjamin Franklin wisely said to “worry about the pennies and the dollars will take care of themselves.”

Each client and situation is unique, however, we can break down the savings for this particular client’s situation.

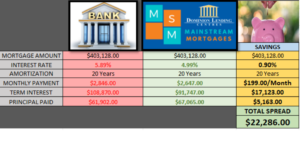

Current Mortgage: At a Big-5 Bank

Mortgage Amount: $403,128.00 at renewal.

Clients have excellent credit and outstanding job tenure and income.

20 years are remaining on their mortgage amortization.

They bought their home with a 10% down payment and the mortgage is default-insured at Sagen Canada.

Their Big-5 bank has offered them a renewal of 5.89% for a 5-year fixed rate and higher rate shorter-term options (I’m not a big fan of this strategy at the moment which will be a topic for another day)

Let’s calculate the numbers: We can offer them a 5-year Fixed Rate mortgage at 4.99% for a 5-year fixed rate.

This client would save:

$199.00 per month on their payment

$17,123.00 in unnecessary interest

$5,163.00 in additional principal would be paid

It’s a spread of $22,286.00!

And since our our lenders offer a 20% payment privilege meaning the payment can be increased by up to 20%, these clients elect to increase their payment by $199/month to pay EVEN MORE PRINCIPAL AND SAVE MORE INTEREST!

This means that the clients will both SAVE AND PAY MORE! They will pay a total of:

$90,175.00 in interest

$80,577.00 in principal

and reduce their amortization to 17 Years and 9 months

IT PAYTS TO GET A SECOND OPINION!

Contact us today!!!

contact form (1)