|

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

|

Weaker-than-expected Jobs Report Keeps Further BoC Rate Cuts In Play

Posted by: Peter Paley

Each Office Independently Owned & Operated

Posted by: Peter Paley

|

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

|

Posted by: Peter Paley

When you receive your mortgage renewal agreement from your lender, stop! Before you sign anything, it’s crucial to get a second opinion from us at Mainstream Mortgages. Transferring your mortgage has never been easier, and it could save you a significant amount of money.

Many Canadians assume their financial institution will offer them the best rate upon renewal. However, this is rarely the case. Almost 70% of borrowers simply sign and return the first mortgage renewal offer they receive from their lender without seeking a better deal.

It’s important to remember: NEVER, EVER accept the first mortgage renewal offer.

Financial institutions, especially large banks, often send renewal offers that are 0.25% to 1.25% higher than the best rates available in the market. They count on the convenience of online renewals and the tendency of customers to avoid negotiation. By simply accepting the offered rate, homeowners end up paying thousands of dollars in unnecessary interest and reducing the amount paid towards the mortgage principal.

It’s wise to start shopping for a new mortgage term between four and seven months before your current term expires. At Mainstream Mortgages, we begin reminding our clients 210 days before their mortgage renewal date. This proactive approach is especially beneficial in a rising interest rate environment, where early renewal can save you from higher rates.

In contrast, during periods of falling interest rates, financial institutions might send renewal offers up to six months in advance, hoping to lock you into a higher rate before rates drop further. This tactic limits your time to find a better deal with another lender. Therefore, it’s essential to track your mortgage term timeframe and start exploring your options early.

Before you hear from your lender about renewing your mortgage, let Peter, Derek, and Colten at Mainstream Mortgages shop around for you. You’ll be amazed at the savings they can secure on your behalf.

Your mortgage is one of your largest expenses, and the Mainstream Mortgage Team can help you save thousands of dollars in interest. Securing the best interest rates and terms is critical to minimizing your costs over the life of your mortgage. Don’t be part of the 70% who simply sign and return their renewal offer. Reach out to the Mainstream Mortgage Team instead.

When we handle a mortgage renewal, we refer to it as either a switch or a transfer. It’s important to note that this involves a full mortgage application process that must be underwritten by the new lender. Fortunately, in almost all cases, the new lender covers the associated fees (legal, transfer, discharge, etc.). Additionally, if your existing lender charges a penalty or other fee, we can include up to $3,000 of these costs in the new mortgage.

P.S. If your current financial institution offers a better deal, we will be the first to let you know.

Posted by: Peter Paley

House hunting can be both an exciting and daunting experience for first-time homebuyers. Two key steps that can significantly enhance this journey are attending open houses and getting pre-approved for a mortgage. In this post, we’ll delve into the benefits of each and how they can set you on the path to finding your dream home.

Open houses provide a unique opportunity to experience properties firsthand. Photos and descriptions online can only tell you so much. By visiting an open house, you can get a real sense of the space, layout, and overall feel of the home. This is invaluable when making such a significant decision.

Additionally, open houses allow you to assess the neighborhood. You can take note of the surrounding area, check out local amenities, and even chat with potential future neighbors. This can give you a better idea of whether the location suits your lifestyle.

Attending open houses also helps you get a feel for the current market. You can compare different properties, see what’s available within your budget, and understand the value of different features and upgrades. This knowledge can be crucial when you’re ready to make an offer.

Engaging with real estate agents at open houses can also be beneficial. They can provide additional insights about the property, the local market, and the buying process. Building relationships with agents can be helpful as you continue your search.

Getting pre-approved for a mortgage is a critical step in the home buying process. First, it helps you understand your budget. A pre-approval gives you a clear picture of how much you can afford to borrow, which narrows down your search to homes within your price range.

Pre-approval also demonstrates to sellers that you are a serious buyer. In a competitive market, having a pre-approval letter can make your offer more attractive compared to those from buyers who have not taken this step.

Additionally, being pre-approved can speed up the buying process. Once you find a home you love, you’ll be ready to move forward quickly, reducing the risk of losing out to another buyer.

Finally, pre-approval can help you avoid disappointment. By knowing what you can afford upfront, you won’t waste time looking at homes that are out of your budget. This focus can make the home buying process more efficient and enjoyable.

Combining open house visits with mortgage pre-approval can streamline your house hunting process. With pre-approval, you can attend open houses with confidence, knowing exactly what you can afford. This allows you to make informed decisions on the spot if you find a property you love.

Being pre-approved also strengthens your negotiating position. Sellers are more likely to take your offer seriously, knowing that you have the financial backing to close the deal.

In summary, attending open houses and getting pre-approved for a mortgage are two essential steps that can greatly enhance your home buying journey. By experiencing properties firsthand and understanding your budget, you can make more informed decisions and find the perfect home for your needs. Start your journey today and take the first steps towards homeownership with confidence.

Posted by: Peter Paley

When it comes to choosing a mortgage, the lowest rate might seem like the obvious choice. However, this common misconception can lead borrowers into tricky situations. In this post, we’ll explore why the lowest mortgage rate isn’t always the best option and what Canadian borrowers should consider instead.

Mortgage rates represent the interest you pay on your home loan. These rates are influenced by various factors, including the Bank of Canada’s policies, economic conditions, and your credit score. While a lower rate means lower monthly payments, it’s essential to look at the bigger picture.

Low mortgage rates often come with hidden costs. Lenders might offset these rates with higher fees, such as processing fees, and other not-so-obvious fees Additionally, low-rate mortgages may have significant penalties for early repayment or refinancing, making them less flexible if your circumstances change, or if you choose to break the mortgage contract early.

Furthermore, low-rate mortgages can come with restrictions. For example, they may not allow for prepayments, have limited portability or may not let you break the mortgage at all (Imagine you try to sell your home and the lender won’t discharge the mortgage). This lack of flexibility can hinder your financial plans if you decide to move or want to pay off your mortgage faster.

Crucial factors to consider:

Comparing variable and fixed rates.

Comparing land title charges – standard vs. collateral.

Comparing title registration amounts – Some lenders instead of registering the amount of your mortgage on the title e.g. ($300,000). Instead of registering $300,000 the lender will register up to $1,000,000.

Comparing features – portability, can the mortgage be assumed, pre-payment privileges

Comparing mortgage penalty calculations – Not all mortgage penalty formulae are the same – choosing the right mortgage can save you $1000s of dollars.

When choosing a mortgage, consider the flexibility and features offered. Prepayment options allow you to pay down your mortgage faster without penalties. Portability lets you transfer your mortgage to a new property without breaking the terms.

Additionally, some mortgages offer features like skip-a-payment options or access to a home equity line of credit. These features can provide valuable financial flexibility and peace of mind, even if they come with a slightly higher rate.

One of the most important factors is Life and disability insurance. Most credit protection policies are not portable. This means that if you wanted to transfer your mortgage to a new lender you may be surprised to find out that your insurance coverage may come to an end. This is a very important consideration for borrowers who become uninsurable due to illness or disability.

Consider Sarah, who chose the lowest rate for her mortgage. She later faced hefty penalties when she wanted to refinance to take advantage of lower market rates ($18,000). On the other hand, John opted for a slightly higher rate with better prepayment options, allowing him to pay off his mortgage quicker and save on interest in the long run.

Consulting with mortgage professionals, like those at Dominion Lending Centres Mainstream Mortgages, can provide invaluable insights tailored to your financial situation and goals. It’s essential to consider your long-term plans and read the fine print before committing to a mortgage.

Remember, the lowest rate isn’t always the best rate. Look at the overall package, including fees, penalties, and features, to find a mortgage that truly suits your needs. An ounce of prevention is worth more than a pound of the cure.

In summary, while the lowest mortgage rate may seem appealing, it’s crucial to consider the broader implications. By understanding the hidden costs and valuing flexibility, Canadian borrowers can make more informed decisions and secure a mortgage that best fits their needs.

Posted by: Peter Paley

DLC Mainstream Mortgages Homebuyers Guide

Embarking on the journey to homeownership is an exciting and significant milestone. At DLC Mainstream Mortgages, we understand that purchasing a home is one of the most important financial decisions you will make. Our New Home Buyer’s Guide is designed to provide you with the essential information and tools you need to navigate the home-buying process with confidence and ease.

Before you start looking at homes, it’s crucial to assess your financial situation. Here are some key factors to consider:

A mortgage pre-approval shows sellers that you are a serious buyer and gives you a clear understanding of how much you can borrow. At DLC Mainstream Mortgages, we make the pre-approval process simple and straightforward:

With your pre-approval in hand, you can start searching for your ideal home. Consider the following tips to streamline your search:

Once you’ve found the perfect home, it’s time to make an offer. Here’s how to proceed:

After your offer is accepted, there are several final steps to complete before you can move into your new home:

Buying a home is a complex process, but with the right guidance and preparation, it can be a smooth and rewarding experience. At DLC Mainstream Mortgages, we are dedicated to helping you every step of the way. Our team of experienced mortgage brokers is here to provide personalized advice and support, ensuring you find the best mortgage solution for your needs. Contact us today to start your journey to homeownership with confidence.

Posted by: Peter Paley

Navigating the world of mortgages can seem daunting, especially for first-time homebuyers. However, understanding the basics can make the process much smoother and less intimidating. Here, we’ll break down the essential components of a mortgage, helping you make informed decisions as you embark on your homeownership journey.

A mortgage is a loan specifically used to purchase real estate. When you take out a mortgage, you agree to repay the lender over a set period, typically 15 to 30 years. The property itself serves as collateral, meaning the lender can take ownership of the property if you fail to make payments.

Selecting the right mortgage depends on various factors, including your financial situation, how long you plan to stay in the home, and your tolerance for risk. Here are a few tips to help you make the right choice:

Understanding the basics of mortgages can help you feel more confident as you navigate the home-buying process. By familiarizing yourself with the key components and different types of mortgages, you can make informed decisions that align with your financial goals and lifestyle. Remember, it’s always a good idea to consult with a mortgage professional who can provide personalized advice and guidance. Happy home hunting!

Posted by: Peter Paley

Everything has a cost.

I was part of a conversation recently. I was listening to different points of view. One person had recently purchased a home and started paying their mortgage, the other stated that interest rates were too high and that they were waiting for either the prices of houses to come down, or for interest rates to come down. I was sitting there sipping my coffee and listening intently to these two perspectives. Suddenly, I heard a deafening silence, as all heads slowly turned in my direction and all eyes were on me. I think waiting will ultimately prove to be incorrect. Home values are starting to increase again, interest rates are slowly coming down, the housing supply is dropping and rents are increasing. Not to mention the amount of money that will be spent on rent that doesn’t build any equity.

I’m not sure who is right and who is wrong in this scenario. Everyone’s situation is slightly different. I bowed out gracefully and I asked both parties to watch our socials this week. This conversation made me ask myself “What interest rate are you paying on your apartment lease/rent?”

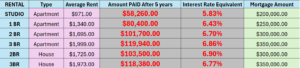

Later on, I pulled out my mortgage calculator and decided to do an interest-only calculation that is compounded monthly. I googled for the average rents in Winnipeg and assigned a reasonable mortgage amount to the rent being paid and came up with the following chart.

The interest rates ranged from 5.83% – 6.90% and the amount of interest paid after 5 years left me gobsmacked!

If you are currently renting, living with your family, or planning to rent soon, I hope you read this post. We would be happy

Posted by: Peter Paley

Sometimes I forget how many different services we offer to ensure that we have to help our clients find the right financial solutions.

We pride ourselves on being experts in all of the products listed above. We have dozens of different lenders and programs to choose from. We can provide you the correct information suited to your own situation and would love to help and answer any questions you may have!

Posted by: Peter Paley

Your mortgage amortization period is the number of years it will take you to pay off your mortgage. Depending on your choice of amortization period, it will affect how quickly you become mortgage-free as well as how much interest you pay over the lifetime of your mortgage (a longer lifetime equals more interest, whereas a shorter lifetime equals less interest but also bigger payments).

Amortization Benchmarks

Let’s start by looking at the mortgage industry benchmark amortization period. This is typically a 25-year period and is the standard that is used by the majority of lenders when it comes to discussing mortgage products. It is also typically the basis for standard mortgage calculators. While this is the standard, it is not the only option when it comes to your mortgage amortization. Mortgage amortizations can be as short as 5 years and as long as 35 years!

Benefits of a Shorter Amortization

Opting for a shorter amortization period will result in paying less interest overall during the life of your mortgage. Choosing this amortization schedule means you will also become mortgage-free faster and have access to your home equity sooner! However, if you choose to pay off your mortgage over a shorter time frame, you will have higher payments per month. If your income is irregular, you are at the maximum end of your monthly budget or this is your first home, you may not benefit from a shorter amortization and having more cash flow tied up in your monthly mortgage payments.

Benefits of a Longer Amortization

When it comes to choosing a longer amortization period, there are still advantages. The first is that you have smaller monthly mortgage payments, which can make home ownership less daunting for first-time buyers as well as free up additional monthly cash flow for other bills or endeavors. A longer amortization also has its advantages when it comes to buying a home as choosing a longer amortization period can often get you into your dream home sooner, due to utilizing standard mortgage payments versus accelerated. In some cases, with your payments happening over a larger period, you may also qualify for a slightly higher value mortgage than a shorter amortization depending on your situation.

Let’s Chat!

We would be happy to help with the decision for the amortization that best suits your unique requirements and ensures you have adequate cash flow. However, it is important to mention that you are not stuck with the amortization schedule you choose at the time you get your mortgage. You can shorten or lengthen your amortization, as well as consider making extra payments on your mortgage (if you set up pre-payment options), at a later date.

Ideally, you are re-evaluating your mortgage at renewal time (every 3, 5, or 10 years depending on your mortgage product). During renewal is a great time to review your amortization and payment schedules or make changes if they are no longer working for you.

Posted by: Peter Paley

More sad news for the Canadian Mortgage space. The Government of Canada’s FTHBI First Time Home Buyer Incentive is going away!

All applications for the incentive will need to be received by March 21st at 12:00 a.m. EST. For single-income households, this program usually made the difference between being able to qualify for a house or condo.

If you are planning on using the incentive, you will need to move fast! After March 21st, your purchasing power could be reduced.

We hope that there will be some good policy and news coming out of Ottawa in the coming months!

Here is the link to the CMHC Website

https://www.cmhc-schl.gc.ca/consumers/home-buying/first-time-home-buyer-incentive?fbclid=IwAR0ajl5LvjQ6ll8rBlsRLq_2s40N3xPAkhaPvWTYlQy0Ap9sinybZoIgKks