When it comes to choosing a mortgage, the lowest rate might seem like the obvious choice. However, this common misconception can lead borrowers into tricky situations. In this post, we’ll explore why the lowest mortgage rate isn’t always the best option and what Canadian borrowers should consider instead.

Understanding Mortgage Rates

Mortgage rates represent the interest you pay on your home loan. These rates are influenced by various factors, including the Bank of Canada’s policies, economic conditions, and your credit score. While a lower rate means lower monthly payments, it’s essential to look at the bigger picture.

The Hidden Costs of Low Mortgage Rates

Low mortgage rates often come with hidden costs. Lenders might offset these rates with higher fees, such as processing fees, and other not-so-obvious fees Additionally, low-rate mortgages may have significant penalties for early repayment or refinancing, making them less flexible if your circumstances change, or if you choose to break the mortgage contract early.

Furthermore, low-rate mortgages can come with restrictions. For example, they may not allow for prepayments, have limited portability or may not let you break the mortgage at all (Imagine you try to sell your home and the lender won’t discharge the mortgage). This lack of flexibility can hinder your financial plans if you decide to move or want to pay off your mortgage faster.

Crucial factors to consider:

Comparing variable and fixed rates.

Comparing land title charges – standard vs. collateral.

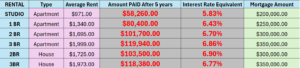

Comparing title registration amounts – Some lenders instead of registering the amount of your mortgage on the title e.g. ($300,000). Instead of registering $300,000 the lender will register up to $1,000,000.

Comparing features – portability, can the mortgage be assumed, pre-payment privileges

Comparing mortgage penalty calculations – Not all mortgage penalty formulae are the same – choosing the right mortgage can save you $1000s of dollars.

Flexibility and Features Matter

When choosing a mortgage, consider the flexibility and features offered. Prepayment options allow you to pay down your mortgage faster without penalties. Portability lets you transfer your mortgage to a new property without breaking the terms.

Additionally, some mortgages offer features like skip-a-payment options or access to a home equity line of credit. These features can provide valuable financial flexibility and peace of mind, even if they come with a slightly higher rate.

One of the most important factors is Life and disability insurance. Most credit protection policies are not portable. This means that if you wanted to transfer your mortgage to a new lender you may be surprised to find out that your insurance coverage may come to an end. This is a very important consideration for borrowers who become uninsurable due to illness or disability.

Case Studies/Examples

Consider Sarah, who chose the lowest rate for her mortgage. She later faced hefty penalties when she wanted to refinance to take advantage of lower market rates ($18,000). On the other hand, John opted for a slightly higher rate with better prepayment options, allowing him to pay off his mortgage quicker and save on interest in the long run.

Expert Tips for Choosing the Right Mortgage

Consulting with mortgage professionals, like those at Dominion Lending Centres Mainstream Mortgages, can provide invaluable insights tailored to your financial situation and goals. It’s essential to consider your long-term plans and read the fine print before committing to a mortgage.

Remember, the lowest rate isn’t always the best rate. Look at the overall package, including fees, penalties, and features, to find a mortgage that truly suits your needs. An ounce of prevention is worth more than a pound of the cure.

In summary, while the lowest mortgage rate may seem appealing, it’s crucial to consider the broader implications. By understanding the hidden costs and valuing flexibility, Canadian borrowers can make more informed decisions and secure a mortgage that best fits their needs.