Everything has a cost.

I was part of a conversation recently. I was listening to different points of view. One person had recently purchased a home and started paying their mortgage, the other stated that interest rates were too high and that they were waiting for either the prices of houses to come down, or for interest rates to come down. I was sitting there sipping my coffee and listening intently to these two perspectives. Suddenly, I heard a deafening silence, as all heads slowly turned in my direction and all eyes were on me. I think waiting will ultimately prove to be incorrect. Home values are starting to increase again, interest rates are slowly coming down, the housing supply is dropping and rents are increasing. Not to mention the amount of money that will be spent on rent that doesn’t build any equity.

I’m not sure who is right and who is wrong in this scenario. Everyone’s situation is slightly different. I bowed out gracefully and I asked both parties to watch our socials this week. This conversation made me ask myself “What interest rate are you paying on your apartment lease/rent?”

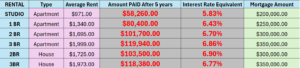

Later on, I pulled out my mortgage calculator and decided to do an interest-only calculation that is compounded monthly. I googled for the average rents in Winnipeg and assigned a reasonable mortgage amount to the rent being paid and came up with the following chart.

The interest rates ranged from 5.83% – 6.90% and the amount of interest paid after 5 years left me gobsmacked!

If you are currently renting, living with your family, or planning to rent soon, I hope you read this post. We would be happy