What To Do In Today’s Mortgage Market

For the past few weeks we have been trying to give tips and advice to navigate the global pandemic.

The most important thing is safety. Please stay home, please wash your hands, please wear a mask when going out of your house. Designate one grocery shopper. Call the Mainstream Team for any mortgage advice or potential deals.

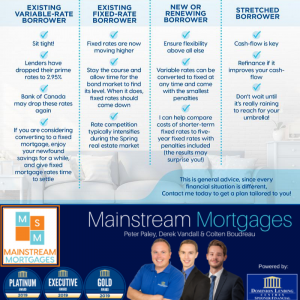

We have had our head office help us with the graphic included in this message and offer it as general advice.

Many of our clients are switching their mortgages, paying their penalties for lower rates. However, many clients are facing more difficult challenges including employment layoffs, reduced income or worse.

For clients who need to sell their homes. Please contact us. We will need to get a new credit application, find out what your mortgage penalty would be should you need to change lenders and what your future income/employment status will be.

For first time buyers. Your employment status has become the most important factor for lenders. Please note that if you become layed-off between the time you release your financing condition and your possession date, your mortgage MAY NOT FUND! We need to figure out back up plans or include extra precautions in your offer to purchase.

Lenders are now under a lot of stress and application queues are forming. Please allow 5 days for financing and allow an additional 4 weeks for closing.

For existing mortgage holders. Contact us directly for advice. If you have equity in your house you may want to tap into it. A full mortgage and financial review is always complimentary and we are happy to do so free of charge.

We apologize there is no video this week as we had a few technical difficulties.