Closing Costs Explained.

Closing costs are one of the largest variables for new home buyers, especially first time home buyers.

All three mortgage insurers require that the clients have their down payment saved + an additional 1.5% of the purchase price for closing costs. The problem with this is, that closing costs are usually closing to 2.5% to 3%. This is really problematic when a client finds out that they are a few thousand dollars short to close.

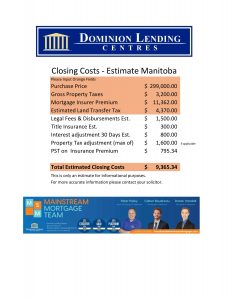

Closing costs include, Land Transfer Tax, Legal Fees and Disbursements, Title Insurance, Interest Adjustment, Property Tax Adjustment as well as any PST on insurer premiums.

Please ask us for our very own closing costs calculator to help calculate your closing costs or down loan our app by visiting our website.

Please watch our video and like it on YouTube and refer to our “Closing Costs Example” for more information. Please feel free to share with your clients.

Click the link below for our YouTube video!

https://www.youtube.com/watch?v=afCGOxdR5fg&t=9s