There has been a lot of buzz about the Renewal Cliff in the media lately. What is it? It is a concern that borrowers will not be able to afford their mortgage renewal in the new higher interest rate environment.

For example, if you purchased a home for $350,000 in Winnipeg, MB in January 2019 with 5% down, you would have a mortgage interest rate near 3.24% the monthly payment would have been $1,652/month.

The mortgage will be renewed in January 2024 with a balance of approximately $292,010 and 20 years left remaining on the amortization. Most banks are offering a renewal rate of 5.89% or higher! This will result in a payment of approximately $2,062 per month, an increase of $410.00/month or about 25%.

There is a fear that in the slowing economy, many borrowers will face work shortages compounded with higher mortgage payments.

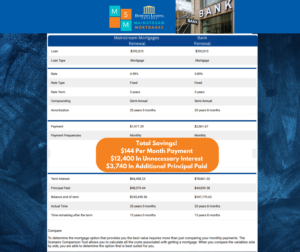

What can be done? Start shopping for a better rate as soon as you can, we recommend 7-8 months before your mortgage renewal. Using the same example above Mainstream Mortgage could get these borrowers a rate of 4.99% for a 5-Year Fixed Rate (at the time of writing and subject to change). This would lower the renewed mortgage payment to $1,917 per month, saving the borrowers $144/month in payment, $12,400 in unnecessary interest over the 5 Year Term, and allow them to pay an extra $3,740 in principal. It always pays to call us to get a 2nd opinion.