When the Future Becomes the Present.

Thinking about retirement before it happens is just common sense. But what questions should you be asking yourself? While seeking the advice of a professional like a retirement advisor can be helpful, there are a few questions to start thinking about as you begin to plan.

Deciding early what your wants and priorities will be in your golden years will determine the steps you need to take now. Will travel be more important to you than having a house big enough for the whole family to visit? Will you want to live simply and not have several cars and a large house? Of course, wants and desires will change over the years, but having a set plan to begin with is a good idea.

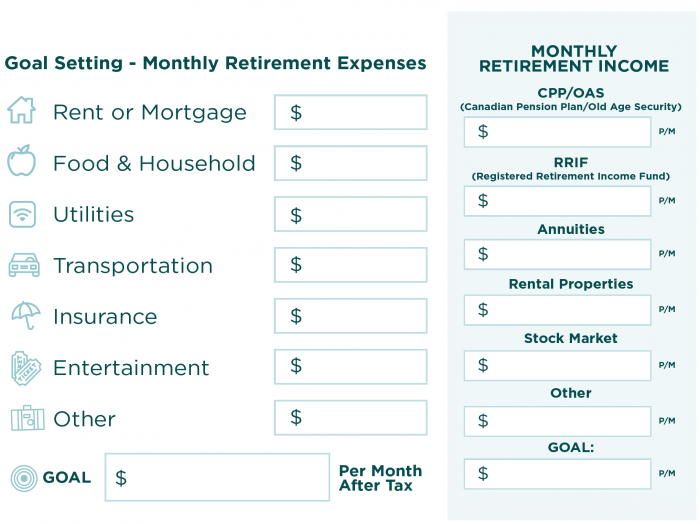

What are your liabilities, income, and expenses? These will be considered when planning your retirement. You need to identify how much money you will need and where it will have to come from.

It is important to identify all possible income sources that will be available to you on the day you retire. Those could include pensions, RRSPs, savings accounts, government benefits, investment property you own, and your home. Keep in mind you don’t want to rely on the Canadian Pension Plan (CPP). The average payout is $20,000 or around $1,300, and is taxable.

If you think you’ve done everything right, life can bring surprises.

DID YOU KNOW…

About 20% of retirees are found to be still paying for mortgages, while 66% are carrying credit card debt.

COMMON FINANCIAL WOES THAT CAN PREVENT RELAXING RETIREMENT

Had to retire early due to a health issue.

A heart attack or a bad back or hip can force people into early retirement. It doesn’t even have to happen to you…it could happen to a spouse and have the same devastating effect. There are a number of health reasons that could keep someone from continuing to work. Don’t rely on disability from the government to cover all your expenses. Make sure you are paying into a RRSP or other investment from an early age so that unexpected illnesses won’t keep you from the retirement you deserve.

Still had unsecured debt.

If you are not aware of your credit card balances, you just might carry that debt into your retirement where you weren’t counting on it still being an expense. It might not have even been a frivolous vacation or an out-of-control spending habit. It’s just the longer you have credit, the more the credit companies will throw at you, so it is best to pay off your balances every month as often as you can.

Still owed on a house and/or investment properties.

Again, retirement can sneak up on you or be forced upon you. When investing in property or managing the mortgage on your primary residence, keep this in mind. A 2nd mortgage might sound fine to pay for an elaborate vacation or to fund a grandkid’s wedding, but you will have to pay it back eventually.

Spent more money before retiring or after retiring than you should have.

People get excited at the prospect of not having to go to work anymore. They see a healthy sum of money in their retirement portfolio and decide they’ve earned a little fun. New cars, expensive vacations, purchasing vacation homes,