Mortgage Refinance

Canadians today face many reasons to refinance their mortgage.

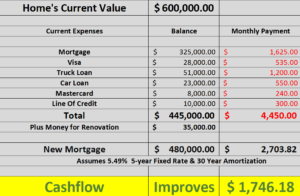

Mortgage Refinancing is an excellent way to use your home’s equity to pay off high-interest rate debts, improve your cash flow, and sometimes even improve your interest rate which can help you save $1000s.

Mortgage Refinancing is also a great way to finance renovations.

Almost all lenders will allow you to borrow up to 80% of the value of your home. For example, if your current home is valued/appraised at $600,000.00 you would be able to apply for a mortgage of $480,000 ($600000 x 80%) & you can choose up to a 30-year amortization.

A few things to consider;

- If your current mortgage is not at the end of its term and you want to refinance a mortgage pre-payment penalty could apply with your existing lender and it is important to have this information.

- In most cases, a full appraisal will be required at the expense of the borrower.

- A legal fee will apply whether you use your lawyer or use the lender’s in-house service.

- If you increase your amortization, you will have to pay your mortgage longer and understand the new interest costs.

Even when you consider these items, a mortgage refinance is an excellent way to help improve your household cash flow and free up money for saving or investing.

Contact us today to see if mortgage refinancing is right for you.